How Did Fdr Make the Banking System Stable Again

"The emergency banking legislation passed by the Congress today is a most effective step toward the solution of the financial and banking difficulties which have confronted the country. The extraordinary rapidity with which this legislation was enacted past the Congress heartens and encourages the country."

—Secretary of the Treasury William Woodin, March 9, 1933

"I tin can clinch you that it is safer to keep your money in a reopened bank than under the mattress."

—President Franklin Roosevelt in his first Fireside Chat, March 12, 1933

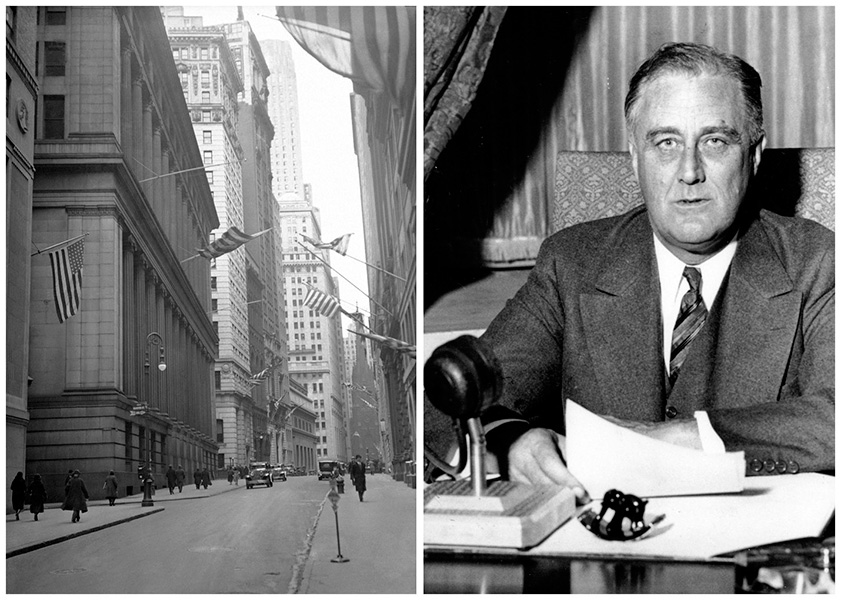

Immediately after his inauguration in March 1933, President Franklin Roosevelt set out to rebuild confidence in the nation's banking arrangement. At the fourth dimension, the Great Low was crippling the US economy. Many people were withdrawing their money from banks and keeping it at home. In response, the new president called a special session of Congress the 24-hour interval later on the inauguration and declared a iv-24-hour interval banking holiday that shut downwardly the banking system, including the Federal Reserve. This activeness was followed a few days later by the passage of the Emergency Cyberbanking Act, which was intended to restore Americans' confidence in banks when they reopened.

The legislation, which provided for the reopening of the banks as soon as examiners found them to be financially secure, was prepared by Treasury staff during Herbert Hoover'south assistants and was introduced on March 9, 1933. It passed subsequently that evening among a cluttered scene on the floor of Congress. In fact, many in Congress did not fifty-fifty accept an opportunity to read the legislation before a vote was chosen for.

In his first Fireside Chat on March 12, 1933, Roosevelt explained the Emergency Banking Act equally legislation that was "promptly and patriotically passed by the Congress ... [that] gave authority to develop a programme of rehabilitation of our banking facilities. ... The new police allows the twelve Federal Reserve Banks to issue additional currency on skilful avails and thus the banks that reopen volition exist able to meet every legitimate phone call. The new currency is being sent out by the Bureau of Engraving and Press to every role of the land."

The Deed, which as well broadened the powers of the president during a banking crisis, was divided into five sections:

- Title I expanded presidential authority during a banking crisis, including retroactive blessing of the banking holiday and regulation of all banking functions, including "any transactions in foreign exchange, transfers of credit between or payments by banking institutions as divers by the President, and export, hoarding, melting, or earmarking of gold or silver coin."

- Championship II gave the comptroller of the currency the ability to restrict the operations of a bank with impaired assets and to engage a conservator, who "shall take possession of the books, records, and assets of every description of such bank, and have such action every bit may exist necessary to conserve the assets of such bank pending further disposition of its business."

- Title III immune the secretarial assistant of the treasury to determine whether a bank needed boosted funds to operate and "with the blessing of the President request the Reconstruction Finance Corporation to subscribe to the preferred stock in such association, State bank or trust visitor, or to make loans secured by such stock as collateral."

- Title 4 gave the Federal Reserve the flexibility to outcome emergency currency—Federal Reserve Depository financial institution Notes—backed past any assets of a commercial bank.

- Title V fabricated the act constructive.

In that Fireside Chat, Roosevelt appear that the next solar day, March 13, banks in the twelve Federal Reserve Bank cities would reopen. Then, on March 14, banks in cities with recognized clearing houses (about 250 cities) would reopen. On March 15, banks throughout the country that government examiners ensured were audio would reopen and resume business organization.

Roosevelt added ane more than boost of conviction: "Call back that no sound depository financial institution is a dollar worse off than information technology was when it closed its doors last week. Neither is any bank which may plow out non to be in a position for immediate opening."

What would happen if bank customers again fabricated a run on their deposits once the banks reopened? Policymakers knew information technology was critical for the Federal Reserve to back the reopened banks if runs were to occur. To ensure the Fed's cooperation to lend freely to cash-strapped banks, Roosevelt promised to protect Reserve Banks against losses. In a telegram dated March 11, 1933, from Treasury Secretarial assistant William Woodin to New York Fed Governor George Harrison, Roosevelt said,

"Information technology is inevitable that some losses may be made past the Federal Reserve banks in loans to their fellow member banks. The country appreciates, yet, that the 12 regional Federal Reserve Banks are operating entirely under Federal Law and the contempo Emergency Bank Act greatly enlarges their powers to adapt their facilities to a national emergency. Therefore, there is definitely an obligation on the federal regime to reimburse the 12 regional Federal Reserve Banks for losses which they may make on loans made nether these emergency powers. I practise not hesitate to assure you that I shall inquire the Congress to indemnify any of the 12 Federal Reserve banks for such losses."

Was the Emergency Cyberbanking Act a success? For the most part, it was. When banks reopened on March 13, it was common to see long lines of customers returning their stashed cash to their banking concern accounts. Currency held by the public had increased by $1.78 billion in the four weeks ending March viii. By the end of March, though, the public had redeposited nearly two-thirds of this cash.

Wall Street registered its approval, as well. On March 15, the kickoff 24-hour interval of stock trading after the extended closure of Wall Street, the New York Stock Exchange recorded the largest i-solar day percentage cost increase ever, with the Dow Jones Industrial Average gaining 8.26 points to close at 62.10; a gain of xv.34 per centum.

Other legislation also helped brand the financial mural more solid, such as the Banking Human action of 1932 and the Reconstruction Finance Corporation Act of 1932. The Emergency Banking Act of 1933 itself is regarded by many as helping to set the nation'south banking arrangement right during the Slap-up Depression.

The Emergency Cyberbanking Human activity also had a celebrated affect on the Federal Reserve. Title I profoundly increased the president'due south ability to bear monetary policy contained of the Federal Reserve Organization. Combined, Titles I and IV took the U.s. and Federal Reserve Notes off the gold standard, which created a new framework for monetary policy.1

Championship III authorized the Reconstruction Finance Corporation (RFC) to provide uppercase to financial institutions. The uppercase injections by the RFC were similar to those under the TARP program in 2008, only they were non a model of the actions taken by the Fed in 2008-09. In neither episode did the Fed inject uppercase into banks; information technology but made loans.

Source: https://www.federalreservehistory.org/essays/emergency-banking-act-of-1933

Belum ada Komentar untuk "How Did Fdr Make the Banking System Stable Again"

Posting Komentar